Cybersecurity Compliance in the Financial Sector

Cybersecurity compliance in the financial sector is of utmost importance due to the nature of financial data and the impact of data breaches.

Today’s financial institutions face a complex landscape of cybersecurity challenges, particularly in the realm of hardware security. In the past, protecting an organization simply meant securing physical premises and hiring guards.

However, the definition of security has evolved. Cybersecurity is now a central concern for financial organizations. As a highly regulated industry managing large volumes of sensitive transactions, compliance efforts must focus on two key pillars: policy enforcement and asset visibility.

Key Priorities for Cybersecurity Compliance in Financial Institutions

Policy enforcement is fundamental to maintaining regulatory compliance. It governs how assets access the network and ensures that unauthorized connections are blocked. But enforcement is only as strong as the visibility behind it.

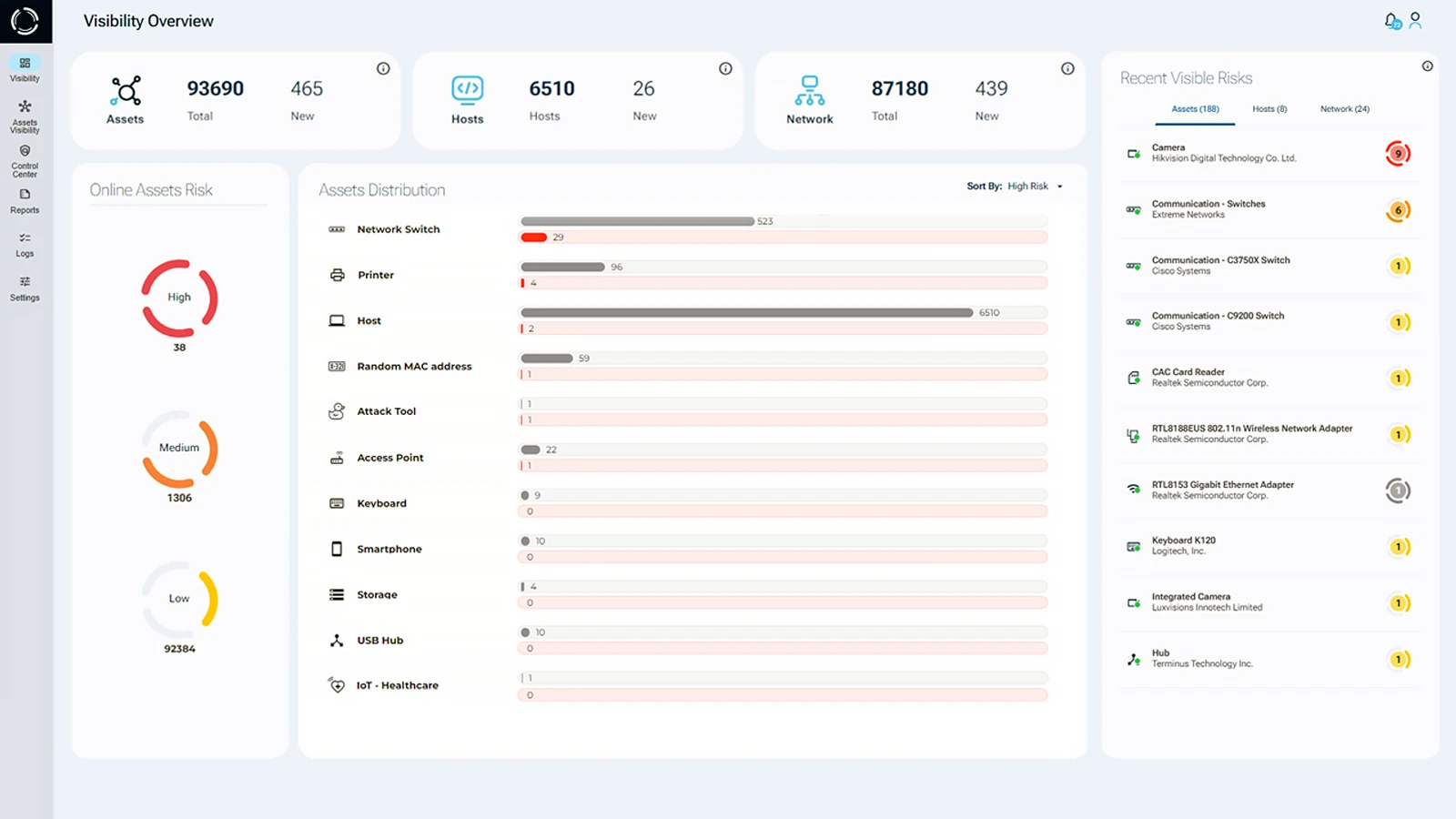

Financial institutions must be able to detect, identify, and monitor every device that connects, or attempts to connect, to their network. With full asset visibility, organizations can implement appropriate controls, meet regulatory standards, and reduce exposure to cyber threats.

Cybersecurity Standards and Regulations for the Financial Industry

When it comes to financial institutions, cybersecurity compliance and the maintenance of strict security controls to protect sensitive data are the number one goals. Asset management is fundamental to such efforts. However, due to the vastness of these companies, the number of assets they must manage is enormous. An accurate asset inventory is crucial. Yet, generating and maintaining a proper asset inventory can be a significant challenge for many international financial entities. A lack of complete asset visibility results in missing device information.

Further, the rise of teleworking, as a result of the pandemic, has opened the door to Bring Your Own Device (BYOD) security risks, leaving the enterprise with a large number of unmanaged assets in its environment. Whether managed or unmanaged, enterprises need complete visibility of all network-connected assets, ensuring the correct security controls are enforced based on the device’s identity. With complete asset visibility, financial enterprises can not only determine a device’s identity but also detect any missed risks and vulnerabilities. The vast array of hardware-based supply chain risks means verifying a device’s integrity is paramount.

Why Traditional Cybersecurity Solutions Fall Short

Existing security solutions fail to provide physical layer visibility, resulting in blind spots in the asset inventory at the hardware level. Lacking this vital level of visibility creates spillover effects that complicate regulatory cybersecurity compliance, mainly weak policy enforcement. Without complete asset visibility, access controls are applied arbitrarily, and unauthorized assets may be granted access due to a case of “mistaken identity” or undetected vulnerabilities.

In an industry as heavily regulated as finance, any breach of policy can have serious ramifications, not to mention the reputational damage that comes with a widely publicized incident.

Achieving Full Asset Visibility for Cybersecurity Compliance

To enhance regulatory cybersecurity compliance efforts and avoid the consequences of a data breach, financial institutions’ cybersecurity must start with visibility at the physical layer. This will allow the enterprise to see what is happening at the hardware security level, providing complete asset visibility that supports dynamic policy enforcement in accordance with the relevant regulations.

For a full understanding of the financial sector’s role in national critical infrastructure, institutions should review the CISA Financial Services Sector page. This resource outlines key considerations and resilience strategies that can guide compliance efforts.

There is no magic bullet for all the challenges associated with cybersecurity in financial institutions. However, Sepio’s solution provides the groundwork for establishing complete asset visibility using Layer 1 data and enhancing policy enforcement through hardware access control rules, ultimately acting as a pillar for regulatory cybersecurity compliance in the financial sector.

Sepio’s Solution for Financial Sector Cybersecurity

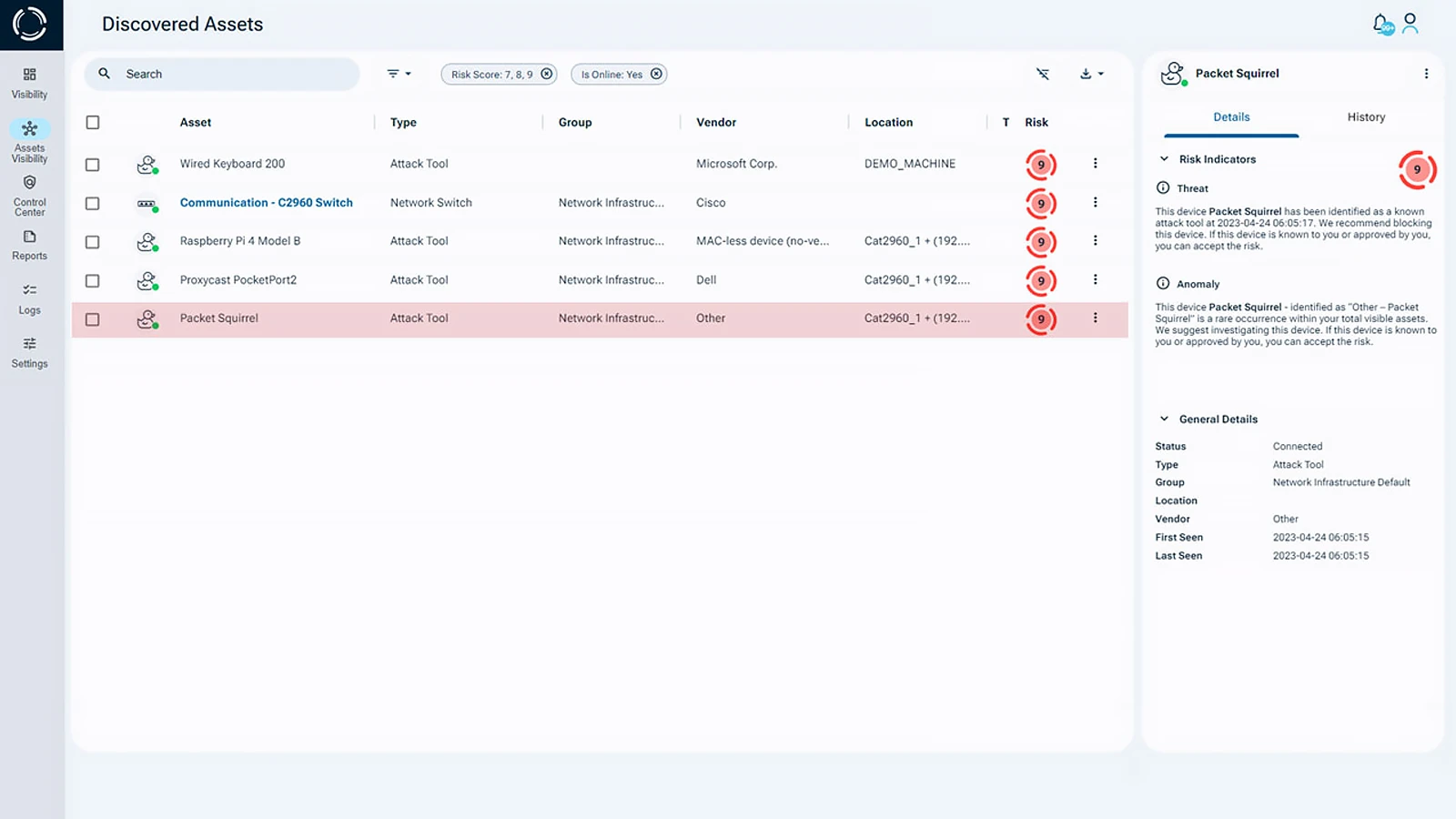

Financial institutions should open a hardware savings account with Sepio. The Sepio platform provides a panacea to the gap in visibility by covering Layer 1, offering complete asset visibility. By going deeper than any other solution, Sepio’s Layer 1 visibility means no device goes unmanaged. Sepio identifies, detects, and handles all IT/OT/IoT devices. Sepio policy enforcement mechanism enables a Zero Trust Hardware Access (ZTHA) approach in which assets’ digital fingerprints, determined by Layer 1 data, are compared against pre-defined hardware access control rules. The solution continuously monitors devices to ensure cybersecurity compliance is maintained in real time.

Sepio’s solution requires no additional hardware resources and does not monitor any traffic. Within 24 hours, we can provide you with complete network asset visibility, identify previously undetected hardware vulnerabilities and risks, without infringing on your privacy. No baseline is required, meaning Sepio will detect every hardware asset, even those that were present prior to installation.

Sepio integrates seamlessly with third-party solutions to enhance existing cybersecurity efforts and maximize previous cybersecurity investments.

Talk to an Expert – Secure Your Financial Organization

Talk to an expert. It will help you understand how to use Sepio’s patented technology to gain control of your asset risks.