Financial Cybersecurity Regulations

Financial Cybersecurity Regulations are rules and laws that govern the operation, structure, and conduct of financial institutions and markets. These cyber security regulations for financial services are put in place by government agencies and international bodies to protect consumers, ensure stability in the financial system, and prevent misconduct and fraud.

Due to the ever-growing number and increasing severity of cyberattacks, financial industry regulators are placing greater emphasis on mitigating cyber risks. As a result, stricter financial cybersecurity regulations are being implemented, with severe penalties for non-compliance. These new regulations will significantly impact chief information security officers’ (CISOs’) asset risk management efforts, and even their roles within their organizations.

New Financial Industry Regulations

Among the recent updates to cybersecurity regulations for financial services is the U.S. Securities and Exchange Commission’s (SEC) proposed “rules and amendments to enhance and standardize disclosures regarding cybersecurity risk management, strategy, governance, and incident reporting by public companies (‘registrants’) that are subject to the reporting requirements of the Securities Exchange Act of 1934.”

These amendments will take effect this spring. They will require public companies to disclose to investors in a standardized manner their policies, procedures and competencies for cybersecurity. Any cybersecurity incidents that occur and updates regarding past cybersecurity incidents.

European regulators also are requiring organizations to strengthen their stances against cybercrime. The European Union’s NIS2 Directive (Network Information Security 2 Directive), which includes “measures for a high common level of cybersecurity across the Union,” takes effect on October 17, 2024 (NIS2 Release Date).

According to its article 21, “essential and important entities must … manage the risks posed to the security of network and information systems… And prevent or minimize the impact of incidents… Strengthening EU’s cybersecurity posture by expanding scope of the directive and introducing more stringent rules. Especially those pertaining to cybersecurity risk management, including among the supply chain.”

Unmanaged Network Devices

With the implementation of new financial cybersecurity regulations, managing cybersecurity and asset risk has become a core business concern for financial organizations—it is no longer solely the responsibility of the security team. According to IT research firm Gartner, corporate boards are increasingly viewing cybersecurity as a significant business risk. As a result, CISOs must present cybersecurity concerns to business stakeholders in terms of business risk, not just technological challenges.

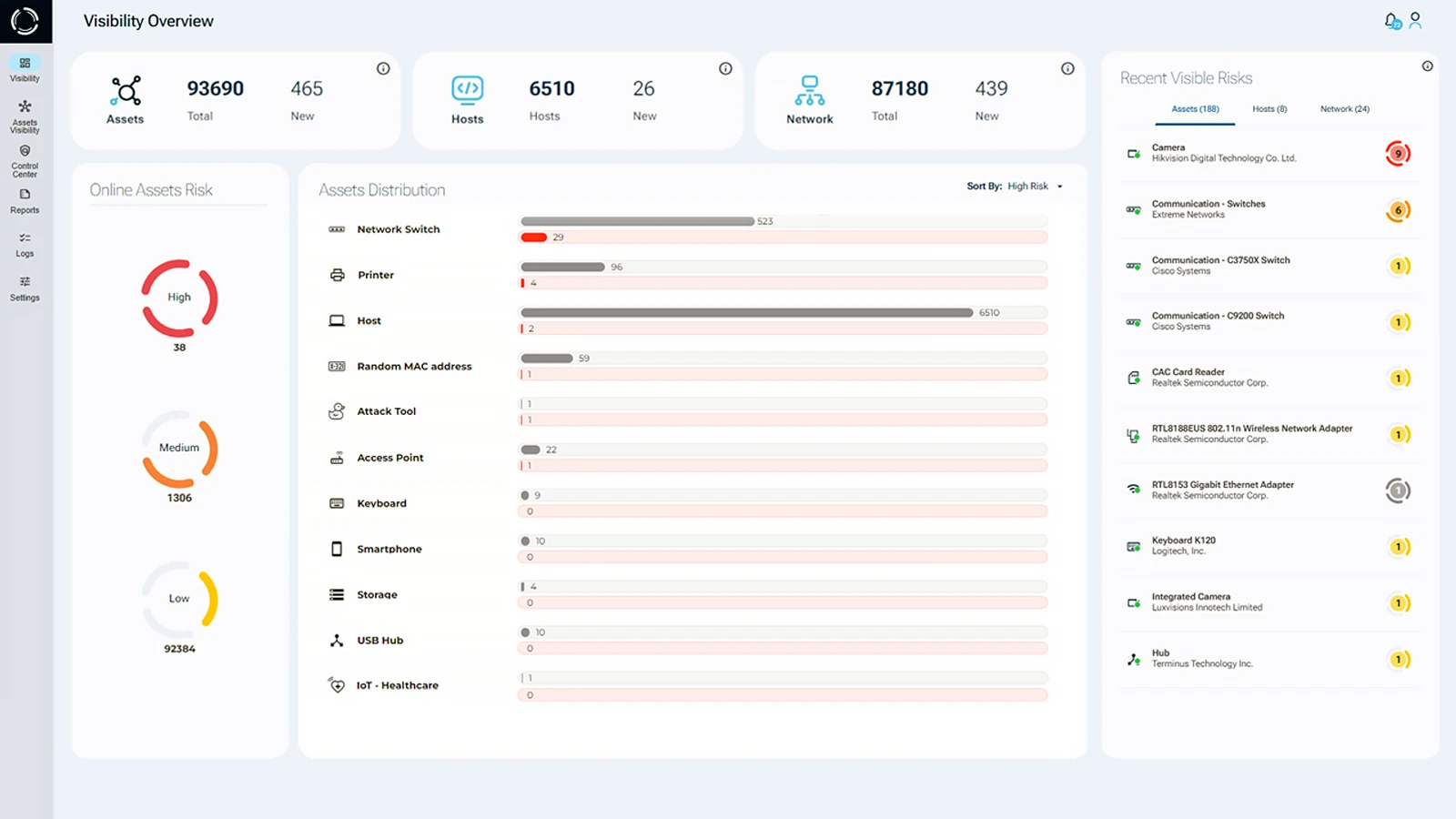

To ensure compliance and address executive concerns, CISOs need comprehensive visibility into their entire asset environment and must effectively manage associated risks.

One of the most pressing challenges is that over 60% of devices connected to a financial services organization’s network go unnoticed and unmanaged. This issue has become even more pronounced with the rise of hybrid working, IoT security, and personal device usage.

Cybersecurity Compliance for CISOs

Although it is a daunting task for CISOs to fully understand their entire asset environment and manage the associated risks, several steps can help make this challenge more manageable.

For example, CISOs can deploy IT asset management solutions that account for any asset type, whether IT, OT, or IoT, regardless of whether the devices are managed or unauthorized, or where they are being used. Additionally, implementing tools to document the presence of both authorized and unauthorized devices is crucial. These solutions should capture details such as exact device models, user identities, how devices are being used, their associated risk levels, and any known vulnerabilities, both at the device and user level.

CISOs should also consider deploying IT asset management solutions that automatically block unknown and unwanted devices breaching access control policies. Continuous monitoring of network-connected devices is essential for ensuring real-time visibility and control, a key component of complying with Financial Cybersecurity Regulations.

Financial Industry Regulations and Unmanaged Network Devices

U.S. financial industry regulations, such as the Securities Exchange Act of 1934, include strict provisions for capturing business communications. Enforcing these requirements is extremely difficult, as employees can use personal devices not connected to the corporate network to communicate about business matters. While the capture of business communications is technically separate from cybersecurity, corporate boards and business leaders increasingly view it as a related business risk involving devices.

Although there is currently no way to monitor communications on devices that are not connected to the network, many devices are connected—and a significant portion of them are unmanaged, outnumbering the managed ones. By identifying and managing all network-connected devices, organizations can improve their ability to capture business communications and enhance compliance with financial regulations.

Compliance Challenges and Consequences

In light of financial cybersecurity regulations, capturing business communications remains a challenge. For example, in September 2022 the U.S. Securities and Exchange Commission announced charges against 15 broker-dealers and one affiliated investment adviser. For “widespread and longstanding failures by the firms and their employees to maintain and preserve electronic communications,” in violation of “certain record keeping provisions of the Securities Exchange Act of 1934.” The firms agreed to pay combined penalties of more than $1.1 billion, and to improve their compliance policies and procedures.

For European financial organizations that don’t comply with the NIS2 Directive, EU member states will be required “to provide a maximum fine level of at least €10,000,000 or 2% of the global annual revenue, whichever is higher.”

CISOs in the financial sector face mounting challenges in adhering to financial cybersecurity regulations. Now, that the SEC ratchet up its enforcement against CISOs that fail to properly disclose their cybersecurity risks (e.g. naming SolarWinds CISO as a defender), a much better management of ALL devices accessing the networks and their associated risks is a must have component of the organization’s cybersecurity and compliance.

Secure Your Financial Assets with Sepio

As financial cybersecurity regulations become increasingly stringent, compliance is no longer optional, it’s essential. With Sepio’s advanced asset risk management solution, financial institutions can gain complete visibility over their asset environment, ensuring compliance with evolving regulations like the SEC’s cybersecurity disclosure rules and the EU’s NIS2 Directive.

Why Choose Sepio?

- Unmatched Asset Visibility: Detect and manage every IT, OT, and IoT device, including those unseen by traditional security tools.

- Regulatory Compliance: Meet financial cybersecurity requirements with real-time monitoring and policy enforcement.

- Risk Mitigation: Prevent unauthorized access, enforce zero-trust policies, and reduce exposure to cyber threats.

Sepio empowers CISOs to protect their organizations against cyber risks while maintaining compliance with the latest cyber security regulations for financial services. Don’t leave your financial assets vulnerable—take control with Sepio today. Contact us now to secure your financial institution’s future.