Cybersecurity Compliance in the Financial Sector

Cybersecurity compliance in the financial sector is of utmost importance due to the nature of financial data and the devastating consequences of breaches.

Today’s financial institutions face a complex landscape of digital threats, particularly in the realm of hardware security. In the past, protecting an organization meant securing physical premises and hiring guards.

However, the definition of security has evolved. Cybersecurity compliance is now a central concern for banks, insurers, and investment firms. As a highly regulated industry managing large volumes of sensitive transactions, compliance efforts must focus on two key pillars: policy enforcement and continuous monitoring of connected systems.

Key Priorities for Cybersecurity Compliance in Financial Institutions

Policy enforcement is fundamental to maintaining regulatory cybersecurity compliance. It governs how devices interact with networks and ensures that unauthorized connections are blocked. But enforcement is only as strong as the monitoring behind it.

Financial institutions must be able to track, authenticate, and control every connected device. Without this, organizations risk blind spots that attackers can exploit. With proper oversight, institutions can implement stronger controls, meet regulatory standards, and reduce exposure to cyber threats.

Cybersecurity Standards and Regulations for the Financial Industry

When it comes to financial institutions, cybersecurity compliance and the maintenance of strict security controls are top priorities. However, due to the global scale of operations, the number of connected devices is vast, making compliance challenging.

The rise of remote work and Bring Your Own Device (BYOD) policies has introduced new risks, leaving organizations with many unmanaged endpoints. Whether personal or company-issued, each device must be governed under strict compliance frameworks.

Further complicating the picture are hardware-based supply chain threats, where attackers exploit weak links to gain entry. For this reason, cybersecurity compliance in the financial sector demands careful validation of all connected technologies.

Common frameworks guiding compliance include:

- NIST Cybersecurity Framework (CSF) – providing best practices for risk management.

- ISO/IEC 27001 – setting standards for information security management.

- FFIEC Guidelines – defining U.S. requirements for banking cybersecurity.

By aligning with these frameworks, institutions demonstrate strong cybersecurity compliance while improving resilience against emerging threats.

Why Traditional Cybersecurity Solutions Fall Short

Existing tools often fail to detect malicious hardware at the physical layer, creating blind spots that undermine cybersecurity compliance. Weak enforcement of access policies allows unauthorized devices to connect undetected, increasing the risk of breaches.

In a heavily regulated industry like finance, these oversights can lead not only to cyber incidents but also to severe compliance penalties and reputational harm.

Regulatory Frameworks and Customer Trust

Another critical dimension of cybersecurity compliance in the financial sector is adherence to international and regional regulations such as:

- GLBA (Gramm-Leach-Bliley Act) in the United States.

- SOX (Sarbanes-Oxley Act) for financial reporting integrity.

- PCI DSS (Payment Card Industry Data Security Standard) for payment systems.

- GDPR (General Data Protection Regulation) in the EU.

Beyond fines and legal consequences, compliance is about maintaining customer trust. Financial institutions are custodians of highly sensitive personal and financial information. Any breach not only results in monetary loss but also erodes public confidence. Strong cybersecurity compliance safeguards reputation as much as it protects data.

Closing Gaps in Cybersecurity Compliance

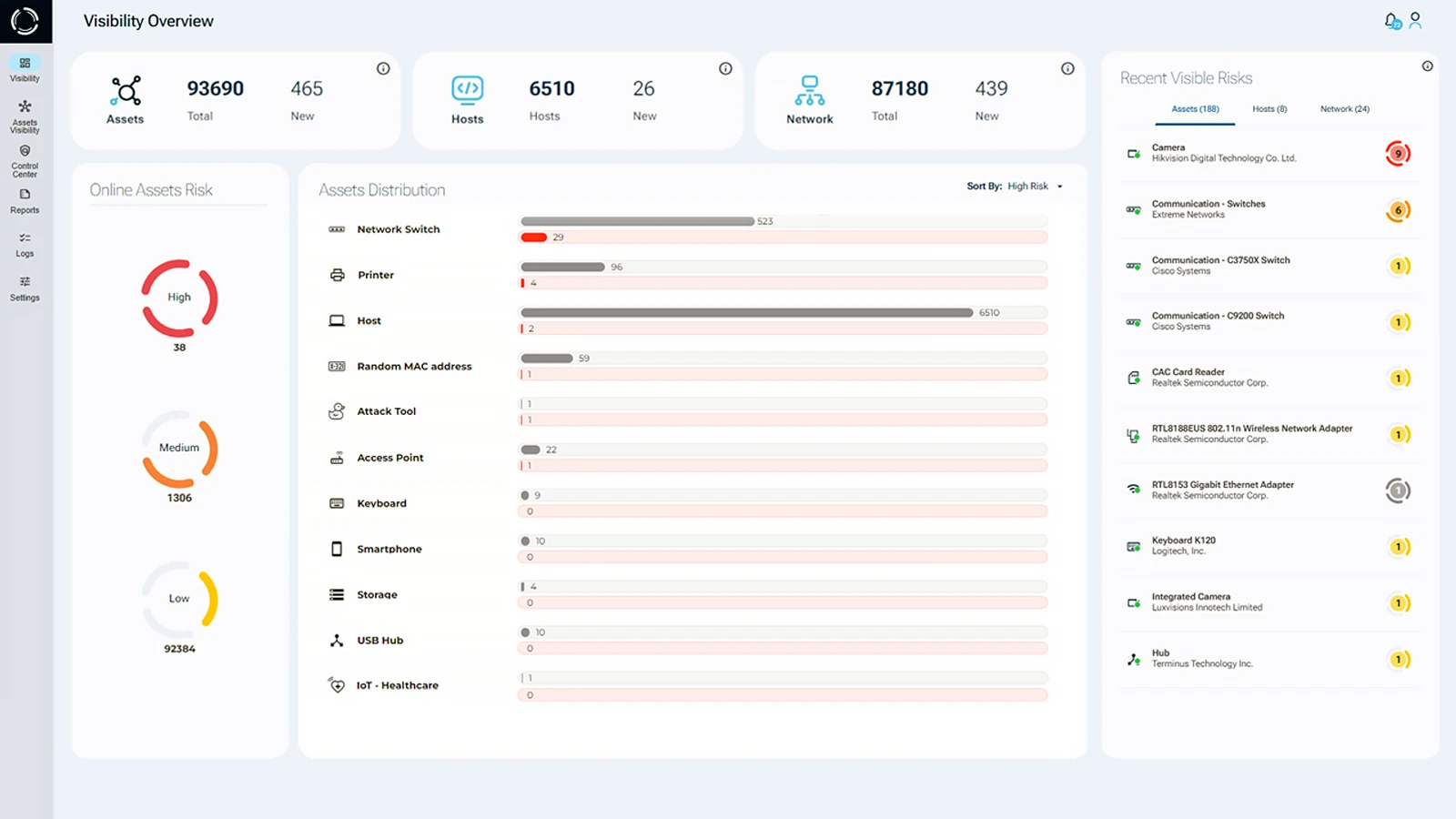

To enhance regulatory cybersecurity compliance efforts and avoid the consequences of a data breach, financial institutions’ cybersecurity must start with visibility at the physical layer. This will allow the enterprise to see what is happening at the hardware security level, providing complete asset visibility that supports dynamic policy enforcement in accordance with the relevant regulations.

By ensuring strict oversight of all network-connected technologies, institutions can enforce policies dynamically and remain aligned with regulatory mandates. This proactive approach significantly reduces the likelihood of both internal errors and external attacks.

For a full understanding of the financial sector’s role in national critical infrastructure, institutions should review the CISA Financial Services Sector page. This resource outlines key considerations and resilience strategies that can guide compliance efforts.

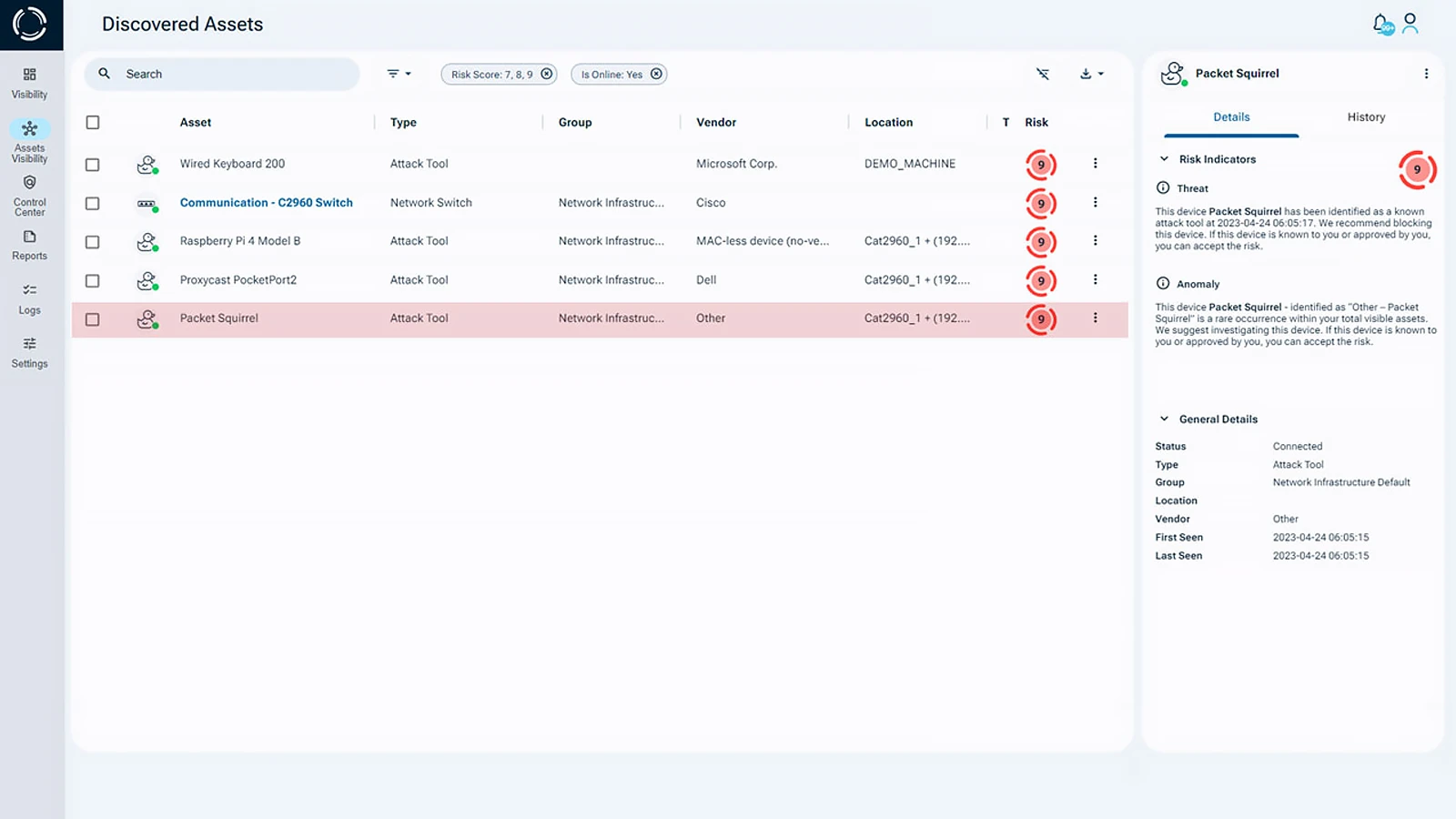

There is no magic bullet for all the challenges associated with cybersecurity in financial institutions. However, Sepio’s solution provides the groundwork for establishing complete asset visibility using Layer 1 data and enhancing policy enforcement through hardware access control rules, ultimately acting as a pillar for regulatory cybersecurity compliance in the financial sector.

Sepio’s Solution for Cybersecurity Compliance

Sepio delivers a unique approach to cybersecurity compliance by addressing the often-overlooked hardware layer. Unlike traditional defenses, Sepio:

- Detects all IT, OT, and IoT devices at the physical connection level.

- Provides policy enforcement mechanisms that prevent unauthorized hardware access.

- Uses digital fingerprinting and comparison against known threat databases to block rogue devices.

- Employs machine learning to identify abnormal device behavior in real time.

Sepio’s solution requires no additional hardware resources and does not monitor any traffic. Within 24 hours, we can provide you with complete network asset visibility, identify previously undetected hardware vulnerabilities and risks, without infringing on your privacy. No baseline is required, meaning Sepio will detect every hardware asset, even those that were present prior to installation.

By integrating with existing third-party security tools, Sepio maximizes prior cybersecurity investments while closing compliance gaps.

Secure Your Organization

There is no one-size-fits-all approach to cybersecurity compliance in the financial sector, but with Sepio’s patented technology, financial institutions can close compliance gaps and defend against even the most sophisticated hardware-based threats.

Talk to an expert. It will help you understand how to use Sepio’s patented technology to gain control of your asset risks.