Cybersecurity for Financial Institutions: A New Era of Threats

In an era of rapid technological advancements, Cybersecurity for Financial Institutions has become more complex and vital than ever. Ed Amoroso, former CISO of AT&T and founder of industry analyst firm TAG Cyber, along with Yossi Appleboum, CEO of Sepio, have collaborated to share valuable research on the growing threat of hardware security risks within the financial sector.

Financial institutions, including banks, credit unions, and investment firms, are increasingly targeted by cybercriminals, making cybersecurity for financial institutions a top priority. These threats are not just limited to traditional cyberattacks like APTs or DDoS attacks. Amoroso and Appleboum’s new research highlights one of the most concerning and overlooked risks: rogue hardware devices.

While digital fraud and cyberattacks continue to escalate, rogue devices, physical pieces of hardware planted within financial institutions, represent an alarming new dimension of risk in cybersecurity for financial institutions. These devices can go undetected for years, granting attackers secret access to sensitive financial systems and data. This makes hardware-based cybersecurity for financial institutions critical to maintaining the integrity and trust that customers expect from these organizations.

Rogue Devices and Cybersecurity for Financial Institutions

Fraud within the financial sector has escalated, and cybercriminals have evolved their tactics to exploit vulnerabilities in both digital and physical infrastructures. According to Amoroso and Appleboum, the traditional bank robber has been replaced by cybercriminals and electronic fraudsters who increasingly rely on hardware-based attacks. One of the most prevalent and damaging threats is the rogue hardware device.

Cybersecurity for financial institutions must evolve to defend against this new generation of attacks that exploit weaknesses at the physical layer. Institutions that fail to address hardware risks expose themselves to long-term undetected breaches and reputational damage.

How Rogue Devices Compromise Financial Institutions Networks

These rogue devices, often undetected for years, are a significant security risk. They can silently infiltrate financial institutions, providing attackers with covert access to sensitive data and critical systems. The presence of these devices can lead to substantial breaches, compromising customer trust and institutional integrity.

Effective cybersecurity for financial institutions requires visibility at the physical layer, knowing exactly what devices are connected and being able to detect anomalies in real time. Without this visibility, institutions remain vulnerable to hidden threats lurking within their infrastructure.

Key Questions Answered in the Research

In their research, Amoroso and Appleboum address several important questions, including:

- How are rogue hardware devices used to execute attacks?

- How can these devices remain hidden within financial institutions for years?

- Which other industries are vulnerable to hardware-based attacks?

By answering these questions, the research supports a stronger cybersecurity strategy for financial institutions, one that includes hardware access visibility and risk management.

Sepio Cybersecurity for Financial Institutions

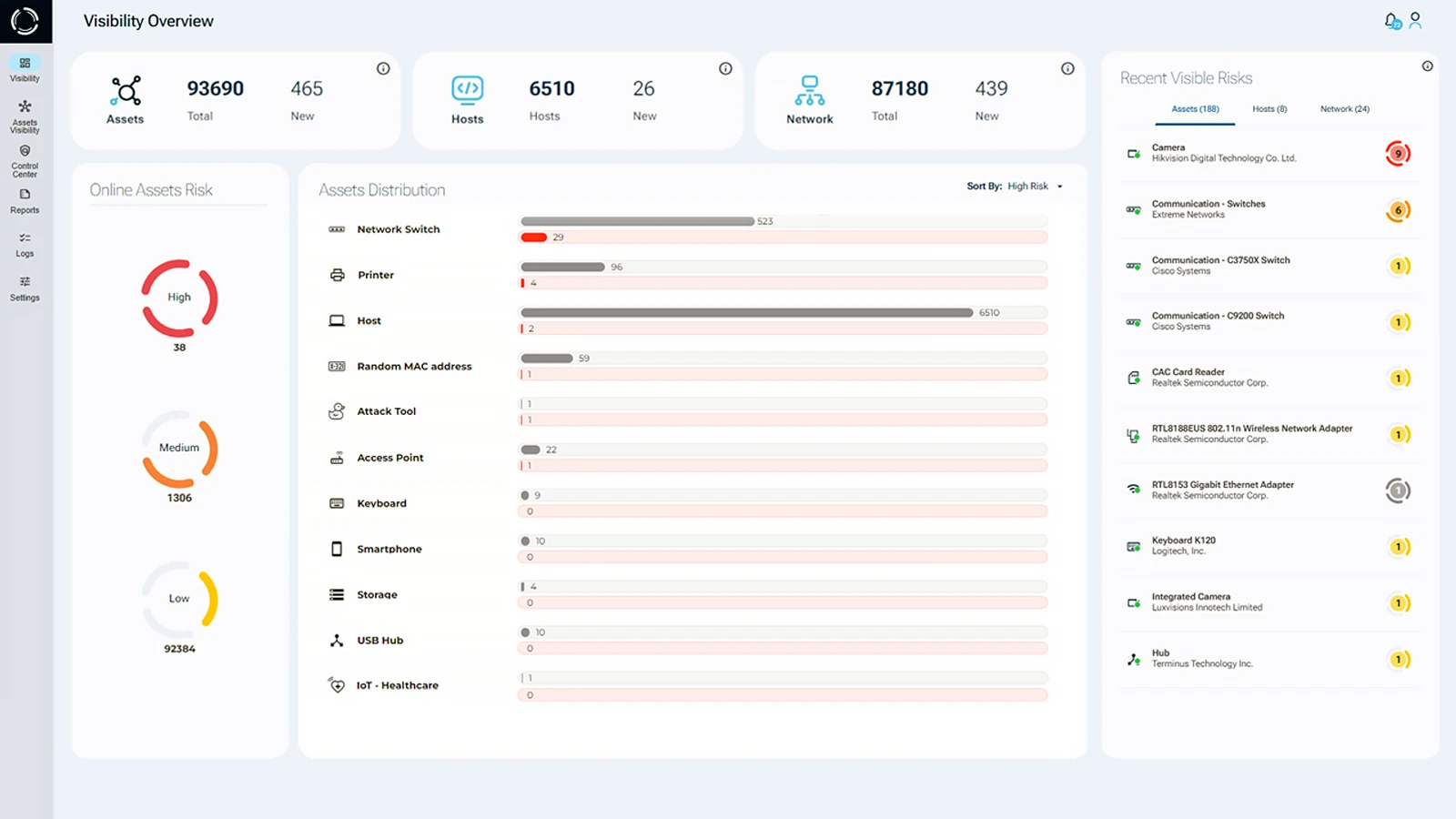

Sepio redefines cybersecurity for financial institutions by focusing on asset-level visibility at the physical layer—where traditional tools fall short. Rogue hardware devices, unmanaged peripherals, and hidden threats are identified instantly, giving your team the insights needed to act before damage occurs.

True Asset Intelligence: By analyzing physical layer data, Sepio builds an Asset DNA for every device, IT, OT, IoT, and more, even those without unique identifiers. This eliminates guesswork and delivers reliable, real-time visibility into your cyber-physical environment.

Risk-Based Protection: Sepio assigns automated risk scores to all assets based on context and behavior, helping financial institutions prioritize what matters most. Continuous monitoring ensures that changes in asset posture are detected and addressed quickly.

Automated Enforcement: Custom policies and integrations with NACs, SOARs, and other platforms allow Sepio to take immediate action, blocking rogue devices or alerting your team without manual intervention.

Protect Your Institution: Schedule a Demo Today

As attackers grow more sophisticated, Cybersecurity for Financial Institutions must go beyond software defenses. Sepio’s solution enables complete asset visibility and detects rogue hardware devices in real time, before they cause damage.

Don’t wait for a breach. Schedule a demo and take control of your cybersecurity today.