Cybersecurity for Financial Services

Financial services cybersecurity refers to the practices, technologies, and frameworks used to protect financial institutions and their customers from cyber threats. These threats range from data breaches and malware to insider attacks and advanced persistent threats targeting infrastructure and data within financial services.

As financial institutions increasingly rely on connected devices, from traditional IT systems to IoT endpoints, cyber risk becomes more complex and difficult to manage. Unmanaged or unauthorized devices often create significant blind spots that weaken cybersecurity, complicate audits, and hinder regulatory compliance in financial services.

Challenges in Cybersecurity for Financial Services

To address these challenges, complete asset visibility is essential. By accurately identifying and monitoring every connected device, institutions can:

- Assess and mitigate risks more effectively

- Enforce appropriate cybersecurity policies

- Maintain compliance with evolving regulatory standards

However, traditional tools such as Network Access Control (NAC) and Intrusion Detection Systems (IDS) often fall short, offering only partial visibility. Without a comprehensive understanding of asset-related risks, financial organizations remain exposed to regulatory violations and cybersecurity incidents.

Legacy Network Access Control

Legacy Network Access Control (NAC) solutions, still commonly used by financial institutions, fall short of providing full visibility into a complete and accurate asset inventory. Rather than detecting unknown or unauthorized devices, NACs use preset lists and only detect devices that are already approved and recorded.

NACs are hard to manage and need a lot of time and resources, making them a poor fit for large setups. They leave visibility gaps that make it hard to enforce rules or control devices, which weakens cybersecurity for financial services.

The Limitations of Passive Monitoring Tools

In financial cybersecurity, some organizations try to make up for NAC weaknesses by using passive tools like intrusion detection systems (IDS). But these “next-gen” tools often cause problems for IT teams. They depend heavily on the network, raise privacy issues, and are hard to use at a large scale. They also need a lot of resources and setup changes, which makes them tough to deploy and leaves parts of the business exposed.

Blind spots in NAC and IDS deployments are frequently exploited by rogue devices that take advantage of these visibility gaps. Payment terminals and ATMs are particularly vulnerable in this context. Malicious devices may impersonate legitimate HIDs by manipulating physical attributes, bypassing traffic-based tools that lack the necessary depth of visibility. As a result, these rogue devices can gain access to ATMs without triggering any alerts, leaving cybersecurity for financial services vulnerable to costly breaches and regulatory noncompliance.

Sepio’s Approach to Cybersecurity for Financial Services

To solve these challenges, Sepio provides a unique, traffic-free approach to cybersecurity for financial services. Its design supports unlimited scaling across all device types, without using up system resources. There are no privacy concerns, no IT issues, and no compliance problems, making it easy to set up and manage financial services cybersecurity.

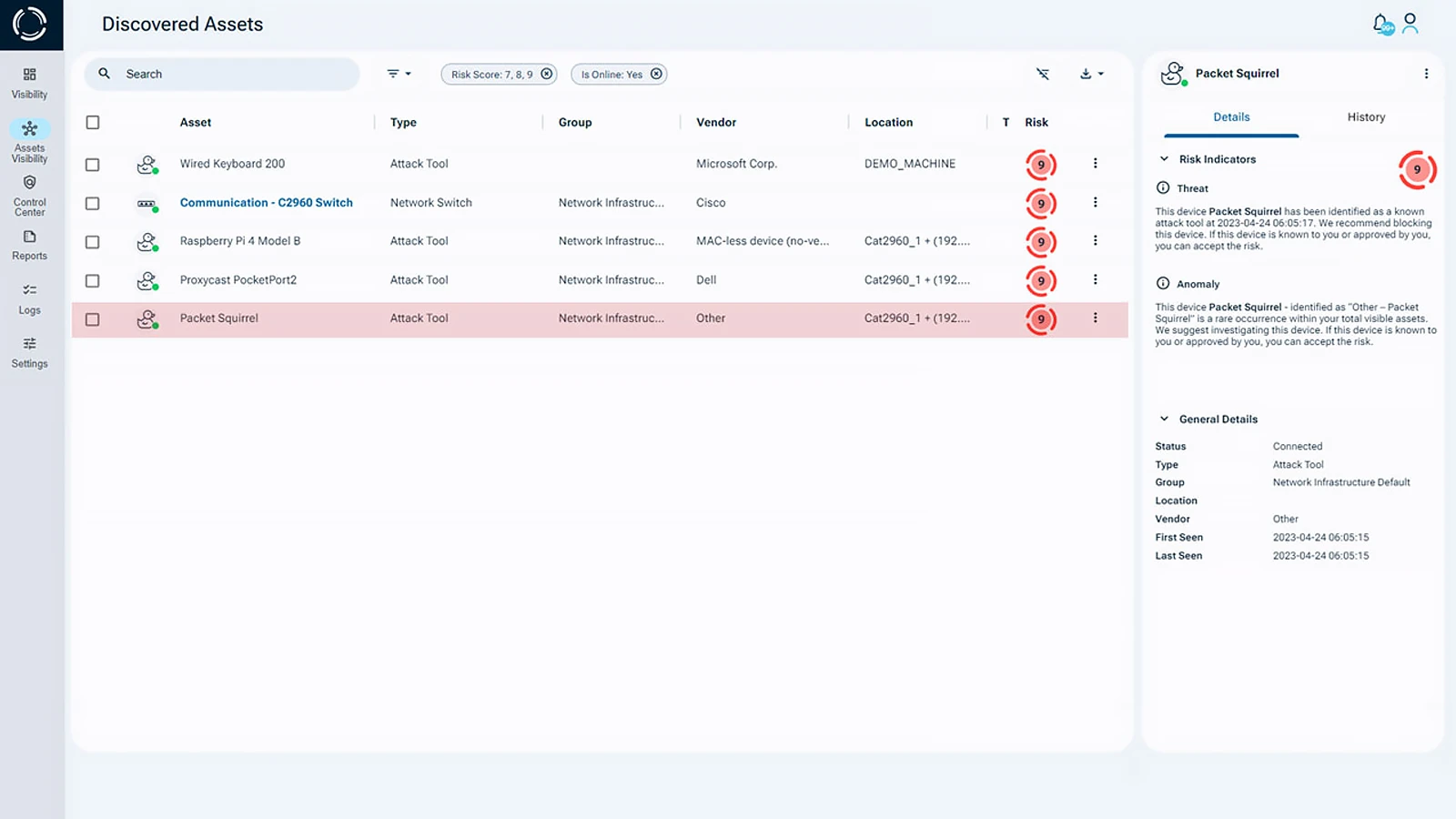

True Asset Identity

Sepio analyzes the physical layer to generate a DNA profile for every known and shadow asset, bringing a new dimension of visibility that closes the gaps of current solutions. The physical layer includes electrical, mechanical, and functional characteristics which provide agnostic visibility and objective truth. Assessing these physical properties means Sepio is untainted by misleading profile perceptions or behavioral assumptions. Every device, no matter its functionality, operability, or location, gets detected and identified for what it truly is. Sepio’s platform eliminates blind spots and offers greater reliability for cybersecurity in financial services.

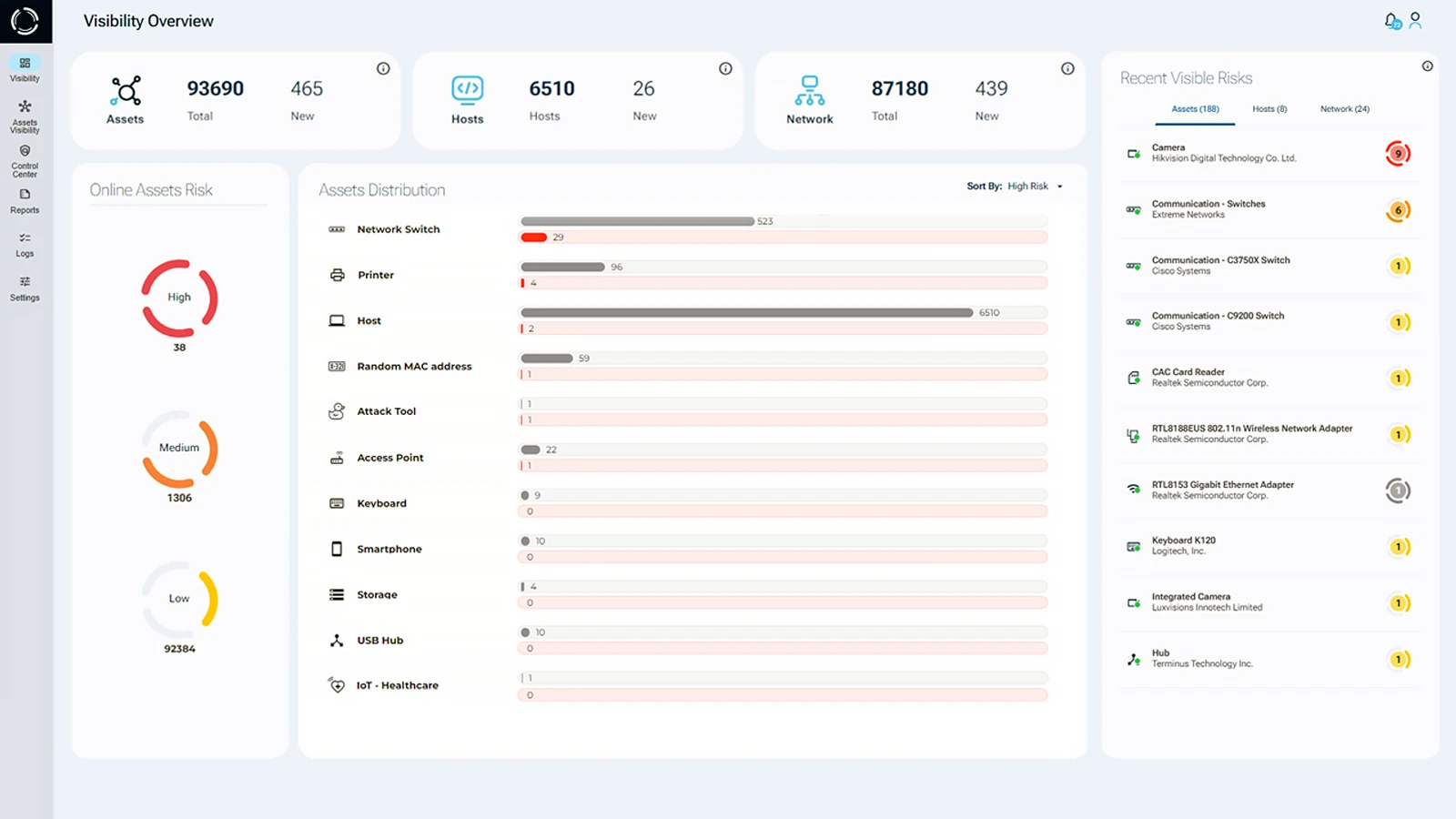

Actionable Visibility and Risk Prioritization

Sepio provides instant insight into which devices need attention. By automatically assigning a contextual Asset Risk Factor (ARF) score to every device, the platform helps cybersecurity teams prioritize threats without sifting through noise. The ARF score evaluates high, medium, and low risks based on each asset’s DNA profile, whether the device is actively in use or not. This enables fast incident response, identifies gaps in regulatory controls, and allows for proactive mitigation. Furthermore, actionable visibility empowers regulation-based policy enforcement, critical for maintaining cybersecurity for financial services compliance.

Greater ROI

Sepio’s platform integrates seamlessly with existing cybersecurity tools, such as NACs, EDRs, XDRs, Zero Trust architectures, and more, to enrich them with deep asset visibility and context specific to financial services.

By drastically improving the performance of your existing investments, Sepio enhances your overall return on IT and cybersecurity expenditures. This makes Sepio an ideal complement to any financial institution’s cybersecurity strategy.

Strengthen Cybersecurity for Financial Services with Sepio

In today’s dynamic digital environment, cybersecurity for financial services is more essential than ever. Sepio provides a comprehensive solution that guarantees full asset visibility, eliminating blind spots in traditional cybersecurity frameworks and enabling more robust regulatory compliance.

By leveraging Sepio Asset Risk Management (ARM), financial organizations gain true visibility into every connected devices, with a precise, contextual risk score. This enables proactive mitigation and the enforcement of regulation-based policies, ensuring compliance and reducing vulnerabilities.

Achieve Full Asset Visibility and Regulatory Compliance

Do not let cybersecurity for financial services challenges hinder your ability to protect valuable assets and service delivery. Sepio’s platform enables financial institutions to achieve complete asset visibility without the resource-heavy burdens of legacy systems. Our technology eliminates blind spots, improves detection, and strengthens the integrity of your network cybersecurity.

- Discover all known and shadow assets

- Provide actionable visibility through contextual risk scores

- Eliminate blind spots and regulatory gaps

- Enforce regulation-based policies

- Mitigate risks from uncontrolled devices

- Fortify efficacy of existing cybersecurity tools

Sepio uses the physical layer to identify devices in a unique and verifiable way. Our built-in ARF scoring system adds another layer of accuracy. Together, they deliver reliable, scalable, and clear asset management, key to strong cybersecurity in financial services.

Start Securing Your Financial Assets Today

Take control of your cybersecurity for financial services by deploying Sepio’s platform. Talk to an expert. Learn how Sepio’s patented technology can provide the comprehensive asset visibility your organization needs to stay protected and keep services running smoothly.

Read the Cybersecurity for Financial Services Brief. (pdf)